What to Do When a Buyer Falls Through

A Seller’s Guide to Recovering, Repositioning, and Closing the Deal

You did everything right. You listed your home, accepted a great offer, maybe even started boxing up your memories. Then out of nowhere—the deal collapses.

If you’re feeling frustrated, discouraged, or just plain stuck, you’re not alone. While a deal falling through might feel like a personal setback, it’s actually a fairly common hiccup in the real estate world.

According to the National Association of Realtors, approximately 20% of real estate transactions experience delays or fall apart completely. But that doesn’t mean the situation is unfixable—or final.

In this guide, we’ll walk you through exactly what to do if your buyer backs out, how to recover with confidence, and what changes you can make to protect your sale the next time around.

Why Real Estate Deals Fall Through (and What You Can Learn from It)

Before we talk strategy, let’s look at the most common reasons a buyer might walk away:

1. Financing Failure

Even buyers who are “pre-approved” can run into issues once the lender takes a closer look. Changes in employment, unexpected debts, or credit score fluctuations can all lead to loan denials at the last minute.

What to do next time: Before accepting an offer, have your agent speak with the buyer’s lender directly. Confirm it’s a fully underwritten pre-approval, not just a pre-qualification.

2. Inspection Deal Breakers

A home inspection can bring surprises—even to the seller. If significant issues arise (foundation cracks, mold, roof problems), buyers may walk or ask for steep concessions you’re unwilling to make.

What to do next time: Consider a pre-listing inspection to get ahead of red flags. If you can’t make all repairs, be upfront in disclosures and price accordingly.

3. Appraisal Gap

Lenders won’t approve a mortgage for more than the home is worth. If the appraisal comes in low and the buyer doesn’t have the funds to cover the gap, they may exit the deal.

What to do next time: Work with your agent to price based on recent comps, not market hype. In competitive markets, negotiate appraisal gap coverage upfront.

4. Contingency Failures

Many buyers include contingencies—clauses allowing them to walk if certain conditions aren’t met. Common ones include the sale of their current home or securing specific financing terms.

What to do next time: Evaluate contingency timelines carefully. Tighten deadlines or favor offers with fewer conditions when multiple bids are on the table.

5. Emotional Back-Out or Cold Feet

Sometimes buyers just change their minds. They get nervous about the commitment, find another property, or reconsider their finances.

What to do next time: It’s hard to prevent this one—but requesting higher earnest money can deter impulsive walkaways.

What to Do Immediately After a Buyer Backs Out

1. Take a Breath—and Call Your Agent

Your real estate agent is your first line of support here. They’ll help you understand what went wrong and begin the process of re-listing or re-engaging with backup offers.

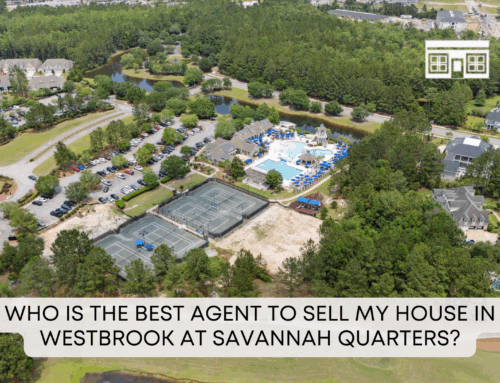

If you’re working with the Heather Murphy Real Estate Group, we likely already have a backup plan in motion—including reactivating buyer interest and re-strategizing pricing if needed.

2. Review the Contract and Protect Your Interests

Your agent (or closing attorney) should guide you through the fine print. Ask:

-

Did the buyer violate any terms?

-

Are you entitled to the earnest money deposit?

-

Were all contingency periods honored?

It’s not always a “win” to keep the deposit, but it can soften the blow and cover your holding costs.

3. Assess the Market Conditions

If you were under contract for several weeks, new listings and sales may have impacted your home’s positioning. Your agent will pull fresh comps and evaluate whether a price or presentation adjustment is needed.

Repositioning Your Listing: A Strong Comeback Plan

Here’s how to bounce back stronger than before:

-

Address Inspection or Appraisal Issues: If those were the problem areas, either resolve them or adjust your price and disclosure strategy accordingly.

-

Refresh Your Listing: Update the photos, rewrite the description, and relaunch the listing with renewed energy.

-

Highlight Improvements: If you’ve made any repairs or upgrades since going under contract, be sure to include those in your marketing materials.

How to Prevent It from Happening Again

While not every failed sale is avoidable, you can take steps to reduce the risk next time:

-

Pre-screen buyers more thoroughly

-

Ask for strong lender letters and larger earnest money

-

Limit contingency periods and renegotiation windows

-

Consider accepting a backup offer as a safety net

-

Stay in communication with your agent at every step

The best agents don’t just help you list your home—they help you plan for the unexpected and pivot fast if needed.

Final Thoughts: You Can Still Close Strong

A buyer backing out of a sale is frustrating—but it’s not the end of your home-selling journey. In fact, with the right support and adjustments, it can become a valuable reset that puts you in a better position than before.

At the Heather Murphy Real Estate Group, we don’t just help you recover—we help you relaunch. From pricing and prep to negotiations and closing, our team is here to help you take the next step with clarity and strategy.

If your deal fell through and you’re not sure what comes next, let’s talk. We’ll guide you through your options and get your sale back on track—stronger and smarter than ever.