What Are the Hidden Costs of Buying a Home in Savannah?

Buying a home in Savannah is one of life’s most exciting milestones. Between the live oaks, charming squares, and Southern hospitality, there’s something truly special about putting down roots here. But when you are preparing to buy, it is easy to focus only on the list price and overlook the many hidden costs that come with homeownership.

Understanding these expenses upfront not only helps you plan wisely but also prevents any surprises after closing. Whether you are a first-time buyer, relocating to coastal Georgia, or upgrading to your dream home, knowing what to expect will make your experience smoother and more rewarding.

The True Cost of Buying a Home

When you find that perfect property, it is natural to focus on the purchase price and your down payment. However, several other costs can affect your budget between the offer and the day you receive your keys. These include closing costs, inspections, insurance, property taxes, and long-term upkeep.

The good news is that with guidance from a trusted local expert like the Heather Murphy Group and our network of lenders and partners, you will understand every number before signing. Let’s break down the key costs every Savannah homebuyer should know.

1. Closing Costs: Where the Numbers Add Up

What Are Closing Costs?

Closing costs are the fees and payments due at the end of your transaction when the property officially transfers ownership. In Savannah, closing costs typically range between two and a half and five percent of the purchase price, depending on your loan type, location, and property type.

On a $400,000 home, this can total between $10,000 and $20,000, which is a significant part of your upfront expenses.

What’s Included in Closing Costs?

While each transaction varies, the most common components include:

-

Lender fees such as origination and underwriting costs for processing your mortgage

-

Appraisal fee to confirm the home’s market value, usually between $400 and $700

-

Title insurance and search to protect you and your lender from potential title disputes

-

Attorney fees since Georgia requires a licensed attorney to conduct the closing, with costs ranging from $900 to $1,200

-

Recording and transfer fees paid to the county for officially recording your ownership

-

Prepaid taxes and insurance, which often represent a large portion of your total costs

Local Insight

Savannah’s closing costs tend to be slightly below the national average because of competitive lender fees and moderate property tax rates. Still, the total can vary based on whether your home is in Chatham, Effingham, or Bryan County.

Working with a local real estate agent and experienced lender ensures you receive an upfront estimate before you commit so there are no surprises later.

2. Property Taxes and HOA Fees

Savannah’s charm comes with diverse neighborhoods, each with its own tax rate and community fees.

Property Taxes in Savannah

On average, homeowners in Chatham County pay around 1.1 percent of their home’s assessed value in annual property taxes. For a $400,000 home, that is roughly $4,400 per year.

If you live in nearby Pooler, Richmond Hill, or Bloomingdale, the rate may vary slightly depending on your school district and local millage rate.

Tip: Property taxes are often escrowed into your monthly mortgage payment, so you are paying them in manageable installments rather than one large sum.

HOA Fees

If you are buying in a gated community or condo development, you will likely have Homeowners Association (HOA) fees.

These can range from $100 to $600 per month, depending on the amenities offered such as pools, clubhouses, landscaping, or private road maintenance.

For example:

-

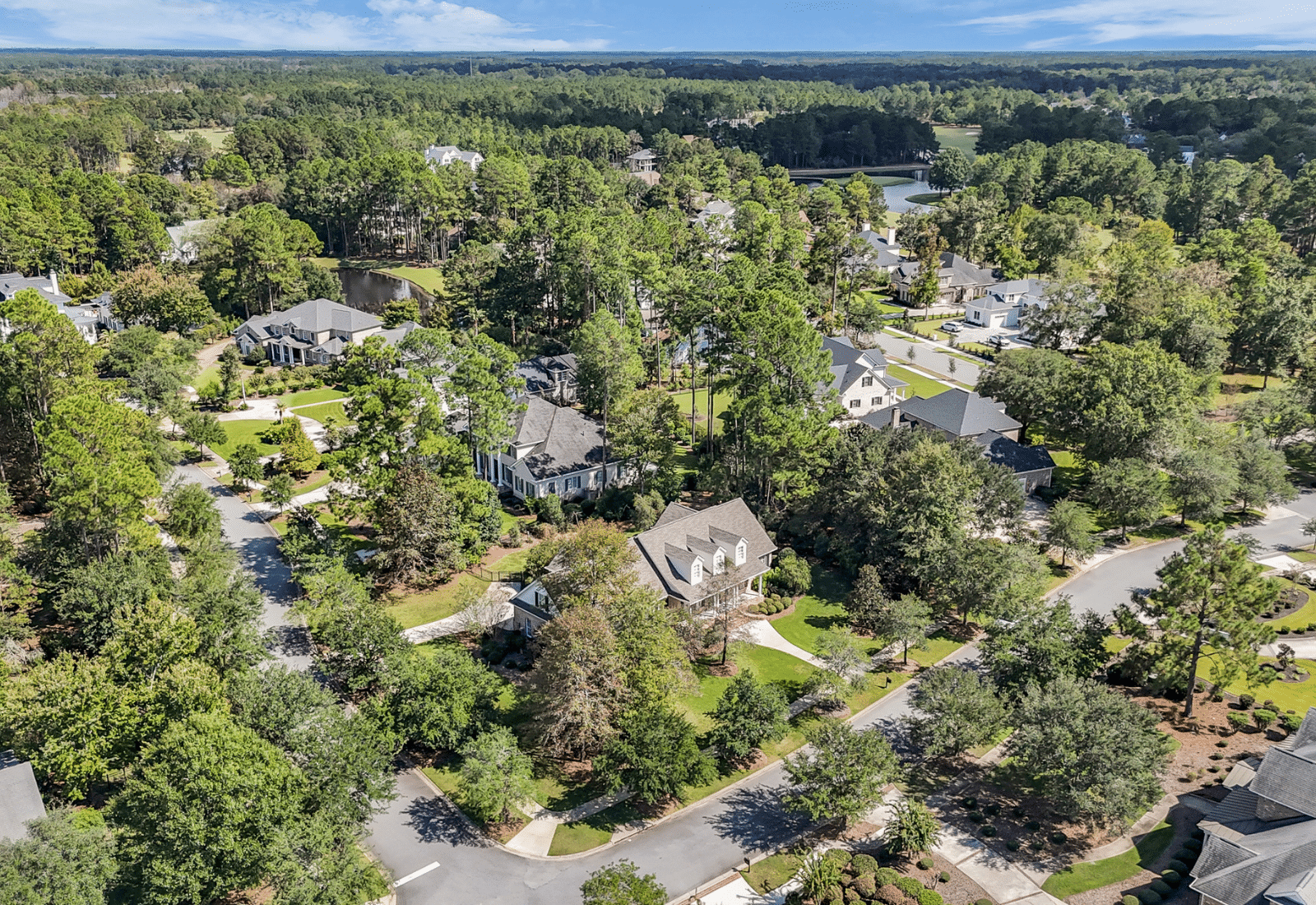

Savannah Quarters in Pooler offers resort-style living with golf, tennis, and fitness facilities that come with higher HOA fees but an exceptional lifestyle.

-

Downtown condos may have lower HOA fees but include shared maintenance and insurance costs.

Your agent will review the HOA documents with you so you know exactly what is included and what is not.

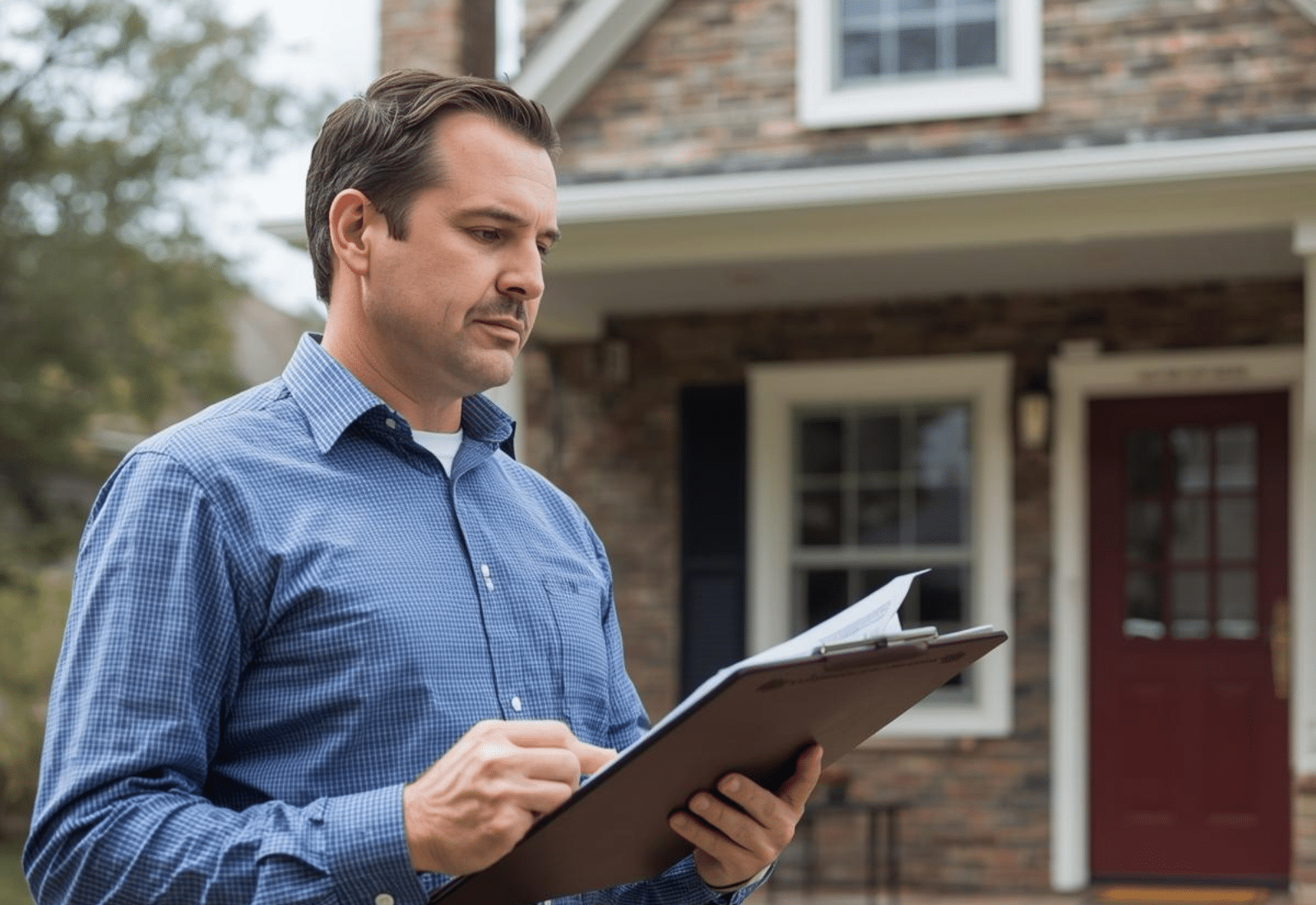

3. Home Inspection and Appraisal Fees

These two steps protect you as a buyer and ensure you are making a sound investment.

-

Home Inspection: Costs typically range from $350 to $600 in Savannah, depending on the size and age of the property. This report reveals potential issues like roof age, plumbing, HVAC performance, or electrical safety so you can make informed decisions before closing.

-

Appraisal Fee: Required by lenders, the appraisal determines the home’s fair market value. This protects both you and your lender from overpaying.

Why Local Experts Matter

Local inspectors understand coastal climate challenges such as humidity, flood exposure, and foundation settling that national companies may overlook.

The Heather Murphy Group connects buyers with trusted inspectors and appraisers who know Savannah homes inside and out.

4. Homeowner’s Insurance and Flood Coverage

Savannah’s location along the coast means homeowners should carefully consider their insurance options.

Homeowner’s Insurance

The average homeowner in Savannah pays around $1,700 to $2,300 annually, depending on the property’s age, size, and location.

Flood Insurance

While not every home requires flood insurance, it is mandatory for properties in FEMA-designated flood zones, which are common in parts of downtown, Thunderbolt, and Wilmington Island. Flood insurance can range from $700 to over $2,000 per year depending on elevation and coverage.

Your agent will help determine whether your home is in a flood zone and connect you with local insurance providers to get the best rates.

5. Utility and Maintenance Costs

Utility Costs

Savannah’s warm climate means higher air conditioning use, especially from May to September. Average monthly utilities in the area such as electricity, water, trash, and internet total between $250 and $350 per month for a typical household.

Maintenance

It is recommended to budget one to two percent of your home’s value annually for maintenance.

That means about $3,000 to $6,000 per year for a $300,000 home.

Coastal humidity can lead to more frequent upkeep such as pest control, HVAC servicing, and paint touch-ups, so planning ahead keeps your home in top shape.

6. Moving Costs and Immediate Upgrades

Do not forget the smaller expenses that add up quickly once you move in:

-

Moving and storage fees that range from $1,000 to $3,000 depending on distance and volume

-

Furniture and décor, as even small updates like curtains, rugs, or light fixtures can add thousands to your move-in budget

-

Immediate repairs such as landscaping, touch-ups, or new fixtures

Having a little extra cushion in your budget ensures these finishing touches do not catch you off guard.

7. Savannah’s Unique Coastal Costs

Living near the coast comes with perks and a few extra expenses worth knowing about:

-

Pest control services are highly recommended because of humidity and lush greenery

-

Lawn care and landscaping typically average between $100 and $200 monthly

-

Storm preparation supplies such as hurricane shutters or generators may be a smart investment

These are not deal breakers but simply part of owning property in one of Georgia’s most beautiful coastal cities.

8. The Role of Your Realtor and Lender Team

Buying a home involves two essential partners, your Realtor and your lender.

Your Realtor: Heather Murphy Group

Our team helps you:

-

Identify homes that fit both your needs and your budget

-

Negotiate closing cost credits when possible

-

Connect with local professionals who can save you money throughout the process

Your Lender: Trusted Partners

We work with Savannah’s most respected lenders including:

-

Jarad Brown and Kelly Sullivan – New American Funding

-

Michael Caputo – First Coast Mortgage

-

Ivy Eilerman – Loan Officer

Each provides personalized guidance on down payment programs, interest rates, and closing cost strategies tailored to your goals.

Together, we ensure you are financially and emotionally prepared for one of life’s biggest investments.

9. How to Budget Smart for a Savannah Home

Here’s how to make your home purchase financially stress-free:

-

Get pre-approved early to understand your budget before starting your search

-

Ask for an estimate of all costs from your lender and Realtor

-

Set aside an emergency fund for unexpected maintenance or job changes

-

Use local experts who understand Savannah’s neighborhoods and market trends

When you have the right team behind you, you’ll know exactly what to expect and that peace of mind is priceless.

10. Why Buyers Trust Heather Murphy Group

At Heather Murphy Group, we do not just help clients buy homes. We help them make smart, confident decisions that build long-term wealth.

Our team lives and works here. We know which neighborhoods are up-and-coming, which areas have the lowest insurance rates, and where you can get the best value for your budget.

From Pooler’s family-friendly neighborhoods to the waterfront lifestyle in Richmond Hill, we have helped hundreds of families find their perfect place. And we will guide you through every step so you are not just buying a house but building a lifestyle.

Ready to Find Your Home in Savannah?

If you’re thinking of buying, we’d love to help you get started. Our local experts and trusted lenders are ready to guide you through every hidden cost, every financial option, and every opportunity to make Savannah your home.