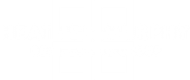

Escrow Explained

The word ‘escrow’ might sound like a complex real estate term to many first-time homebuyers. However, a clear understanding of escrow is crucial for successfully navigating the home buying process. Escrow plays a pivotal role in ensuring a fair and secure transaction for both buyers and sellers. As a term you’ll often encounter on your journey to homeownership, familiarizing yourself with what it means and how it works can make your home buying experience smoother and more transparent.

What is Escrow?

Put simply, escrow is a financial arrangement where a third party holds and regulates the payment of funds required by two parties in a given transaction. It’s like having a neutral middleman to ensure everyone sticks to their end of the deal.

During a home purchase, an escrow account securely holds money throughout the transaction process. This account holds the buyer’s earnest money – a deposit demonstrating the buyer’s good faith in purchasing the home. The escrow account also plays a critical role during the closing process. Here, it holds funds from the buyer and disburses them to the seller once the sale meets all conditions. This system ensures the seller doesn’t receive payment until fulfilling all obligations, and the buyer doesn’t pay until gaining rightful ownership of the property.

Understanding escrow is fundamental in buying a home, offering protection and peace of mind to both transaction parties.

The Parties Involved in Escrow

Several key players ensure the smooth running of any escrow arrangement in a real estate transaction.

- The Buyer: The buyer kicks off the escrow process by depositing earnest money, showing their commitment to the transaction.

- The Seller: The seller agrees to the escrow terms, which include fulfilling certain conditions or requirements before finalizing the sale.

- The Escrow Agent: Often a neutral third party, the escrow agent takes responsibility for holding and disbursing funds as per the buyer and seller’s agreement. They make sure all sale conditions are met before any money changes hands.

- Other Involved Parties: This group can include real estate agents, attorneys, mortgage brokers, and title companies. Each plays a role in facilitating different aspects of the transaction.

The Escrow Process Step-by-Step

Understanding the escrow process can demystify the steps from making an offer on a home to owning it.

- Opening an Escrow Account: After the seller accepts your offer, you open an escrow account to securely hold your earnest money deposit.

- Deposit of Earnest Money: The buyer deposits the earnest money as a sign of good faith in proceeding with the purchase.

- Fulfilling Contingencies: The buyer and seller work together to meet any contingencies in the purchase agreement, such as home inspections, repairs, or obtaining mortgage approvals.

- Final Walkthrough and Verification: Before closing, a final walkthrough occurs, and the escrow agent verifies that all sale conditions have been satisfied.

- Signing Closing Documents: Both parties sign all necessary documents, including those for the title transfer and the buyer’s mortgage.

- Closing Escrow: After fulfilling all terms and signing the documents, the escrow agent releases the funds to the seller. The sale completes, and the buyer officially owns the property.

Understanding Escrow in Your Real Estate Transaction

Escrow is designed to protect everyone involved in a real estate transaction. Here’s how it works for the buyer and the seller:

- Protection for the Buyer: Escrow protects the buyer by holding the earnest money and ensuring satisfaction of key conditions like the property’s title, inspections, and repairs before releasing funds to the seller.

- Protection for the Seller: For sellers, escrow offers security by confirming the buyer’s financial capability to complete the purchase. It also ensures the secure holding of the buyer’s earnest money until finalizing the transaction.

Key Terms Explained

- Earnest Money: This deposit from the buyer demonstrates their seriousness about the property purchase. Typically, it’s a percentage of the purchase price and is credited towards the final sale price.

- Closing Costs: These fees and expenses, separate from the property price, are paid at the real estate transaction’s end. They can include loan processing fees, title insurance, and inspection charges.

Tips for Navigating the Escrow Process

For first-time homebuyers, navigating the escrow process can seem daunting. Here are some tips for a smoother experience:

- Stay Organized: Keep all important documents, like loan paperwork and home inspection reports, in order.

- Understand the Timeline: Escrow timelines can vary, typically ranging from 30 to 60 days. Familiarize yourself with key dates and your responsibilities at each stage.

- Communicate Regularly: Maintain regular contact with your real estate and escrow agents. Ask questions if any part of the process is unclear.

- Be Prepared for Closing: Review the closing documents in advance. Make sure you understand them and have the necessary funds ready for closing costs.

Approaching the escrow process with understanding and preparedness can significantly smooth your journey to homeownership.

Common Escrow Challenges and How to Address Them

Even with careful planning, the escrow process can present challenges. Being aware of these potential issues can help you navigate them more effectively:

- Delays in the Process: Delays can occur due to various reasons like loan approval issues, home inspection findings, or title problems. To address these, maintain clear communication with your real estate agent and lender, and address any contingencies as quickly as possible.

- Appraisal Issues: Sometimes, a property may not appraise for the agreed-upon sale price. This is known as an appraisal gap. If this happens, you may need to renegotiate the sale price, request a second appraisal, or, if you’re the buyer, cover the difference.

- Last-Minute Negotiations: Occasionally, final walkthroughs can lead to additional negotiations. Be prepared to compromise or address any newfound issues to keep the process moving forward.

Final Thoughts

Understanding the escrow process is a crucial part of buying a home. It provides a secure way to handle the financial aspects of your transaction, ensuring both the buyer and seller meet their obligations before the sale is finalized. Familiarizing yourself with how escrow works, its challenges, and ways to navigate them can significantly contribute to a smoother home buying experience.

If you’re embarking on your home buying journey and find yourself needing guidance through the escrow process, the Heather Murphy Group is here to help. Our experienced team is well-versed in the nuances of real estate transactions and is dedicated to supporting you every step of the way.

Reach out to us at Heather Murphy Group for expert assistance in navigating the escrow process and any other aspect of buying a home. Let us help make your path to homeownership as clear and stress-free as possible.