Cost of Living Breakdown for Savannah Homebuyers

Buying a home in Savannah is not just about choosing a property you love. It is also about understanding the cost of living that comes with owning a home in this beautiful coastal city. Whether you are considering a historic home downtown, a new build in the suburbs, or a peaceful retreat on one of Savannah’s islands, each lifestyle comes with its own financial rhythm.

This guide breaks down what Savannah homebuyers can realistically expect. It blends local insight, current cost data, and practical planning guidance so you can explore homeownership with clarity and confidence.

Savannah’s Cost of Living at a Glance

Savannah continues to attract buyers because it offers a meaningful balance between lifestyle, character, and affordability. Recent national and regional data consistently show:

-

Savannah’s overall cost of living index trends slightly below the U S average.

-

Housing remains one of the most appealing factors, with many buyers finding more value here compared to other coastal cities.

-

Utilities tend to be slightly higher than national averages due to climate and seasonal HVAC use.

-

Everyday expenses such as groceries, transportation, and entertainment generally align with other mid-sized Southern cities.

For many buyers, this combination creates a strong value proposition: a well-balanced cost of living paired with an exceptional lifestyle.

Understanding the Core Components of Homeownership Costs

Every Savannah homeowner will encounter some combination of the following expenses. The total varies depending on where you buy, how you live, and the type of home you choose.

Home Price and Mortgage

Savannah’s home prices range widely depending on property age, size, condition, and neighborhood. Historic homes, newer builds, and island properties all follow different pricing patterns.

Property Taxes

Chatham County property taxes typically fall near national averages. Georgia assesses property at 40 percent of fair market value before applying millage rates, and exemptions can reduce taxable value for primary homeowners.

Homeowners Insurance

Insurance costs depend on the home’s age, size, materials, updates, and proximity to water. Flood insurance may be required or recommended based on FEMA flood zone designations.

Utilities

Electricity, water, sewer, and gas vary depending on home size, insulation, appliance efficiency, and usage. Savannah homeowners generally see electricity costs in the two hundred to three hundred dollar range monthly, with total utilities dependent on lifestyle and season.

Maintenance and Upkeep

Historic homes may have higher maintenance needs due to age and craftsmanship. Newer builds usually require less. Island and coastal homes may need additional care due to humidity, salt air, and storm exposure.

Transportation

Savannah’s walkable city core reduces commute needs, but island and suburban living may include regular transportation costs.

Cost Scenarios for Savannah Homebuyers

Below are three lifestyle scenarios to help you compare possible monthly expenses excluding mortgage payments. These represent typical ranges and illustrate how costs shift depending on home type, lifestyle, and personal habits.

⭐ Scenario 1: The Basic Homeowner

Best for: Buyers focused on starter homes, smaller properties, efficient living, or modest utility usage.

Home Type: Small historic cottage, compact new build, or modest suburban home

Utilities: Around two hundred to two hundred seventy dollars

Property Taxes: Lower to moderate

Insurance: Moderate depending on location and age

Maintenance: Light upkeep

Lifestyle Expenses: Minimal dining out and entertainment

Estimated Monthly Cost (excluding mortgage):

$1,400 to $1,800

This homeowner focuses on simplicity and predictable monthly expenses. They enjoy Savannah’s parks, outdoor squares, free events, and community experiences.

⭐ Scenario 2: The Comfortable Homeowner

Best for: Buyers choosing mid-sized homes, families, or those who want a balance of comfort and convenience.

Home Type: Mid-sized historic home with updates, suburban new build, or well-maintained island property

Utilities: Around three hundred to three hundred twenty-five dollars

Property Taxes: Moderate

Insurance: Moderate to higher based on proximity to water or home age

Maintenance: Regular annual projects, lawn care, and HVAC servicing

Lifestyle Expenses: Dining out, entertainment, activities, groceries

Estimated Monthly Cost (excluding mortgage):

$2,200 to $2,800

This scenario represents the typical Savannah homeowner who enjoys comfort and community. They may gravitate toward neighborhoods like Ardsley Park, Wilmington Island, Isle of Hope, Pooler, or Richmond Hill.

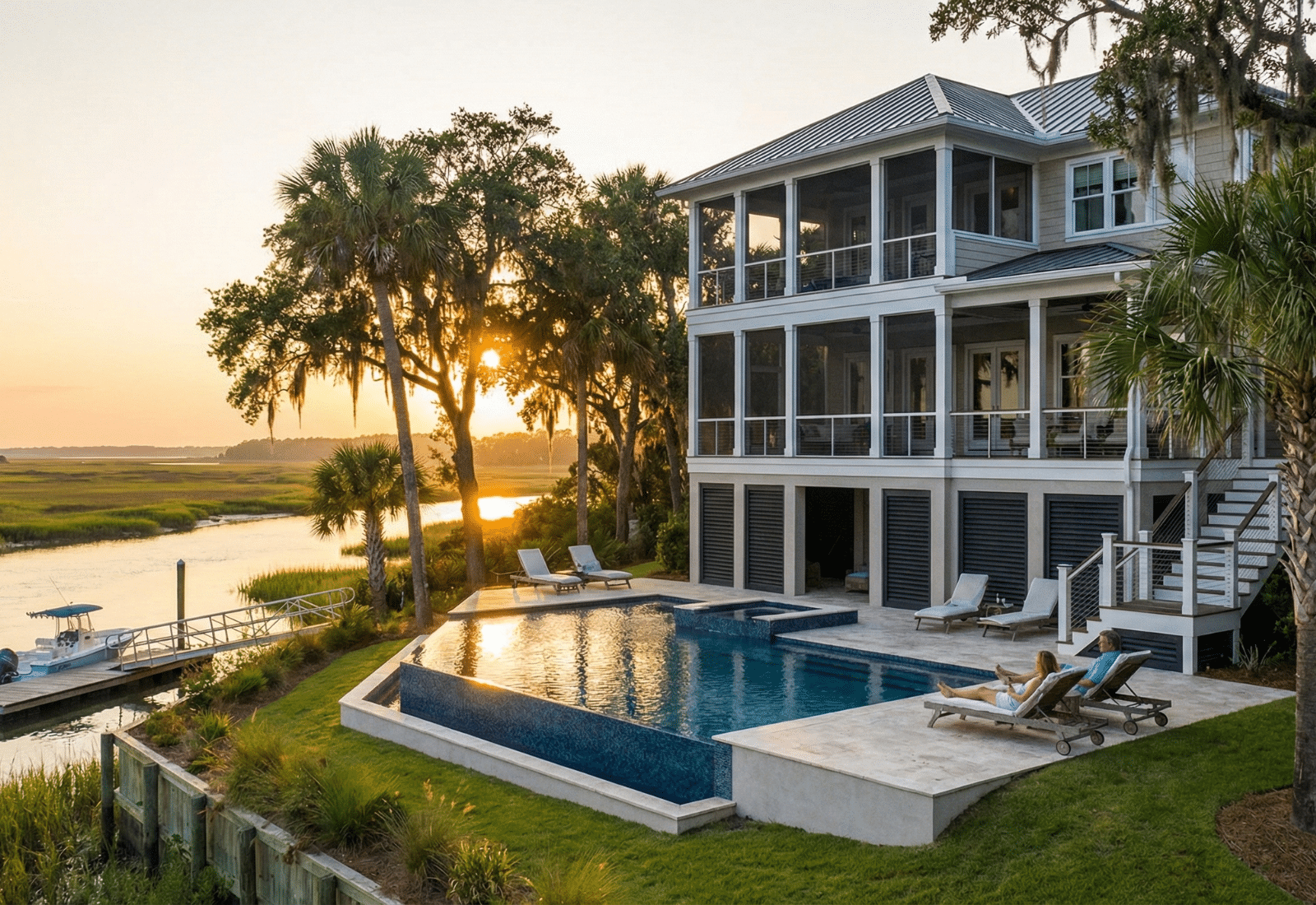

⭐ Scenario 3: The Luxury or Coastal Homeowner

Best for: Buyers who prioritize space, coastal access, updated features, or an elevated lifestyle.

Home Type: Large historic home, luxury new build, deepwater or marshfront island home

Utilities: Four hundred to six hundred dollars

Property Taxes: Higher due to home value

Insurance: Higher for coastal or older homes

Maintenance: Landscaping, exterior upkeep, tree care, storm preparation

Lifestyle Expenses: Dining, memberships, events, travel, higher grocery and entertainment spending

Estimated Monthly Cost (excluding mortgage):

$3,500 to $4,500 or more

These homeowners often choose properties on Skidaway Island, Dutch Island, Tybee Island, Whitemarsh Island, or premium pockets of downtown Savannah where character and comfort meet.

What Makes Savannah’s Cost of Living Attractive

Savannah continues to be appealing for homebuyers because:

Housing Affordability

You can often get more home for your money compared to many coastal markets.

Reasonable Property Taxes

Georgia’s tax structure helps keep long-term expenses manageable.

Manageable Everyday Costs

Groceries, transportation, and lifestyle expenses are generally in line with national averages.

Diverse Neighborhood Options

Historic homes, suburban convenience, modern new builds, and island living all exist within a short drive of each other.

Lifestyle Flexibility

Savannah makes it easy to choose a home and a neighborhood that align with your financial comfort level.

Tips for Planning Your Homeownership Budget

To determine where you fit within these scenarios, consider the following:

-

How much space you truly need

-

Whether you prefer historic charm or modern convenience

-

Your lifestyle habits and monthly spending

-

The neighborhoods that feel most like home

-

How much maintenance you feel comfortable managing

-

Your long term vision for homeownership in Savannah

The clearer your priorities, the easier it becomes to choose a home that aligns with your goals.

Final Thoughts: Savannah Offers Value, Lifestyle, and Long Term Possibility

Savannah is a place where homeownership feels meaningful. Whether you are drawn to historic charm, suburban ease, or coastal tranquility, the cost of living here can be shaped around your needs and your stage of life.

When you understand how utilities, taxes, insurance, maintenance, and lifestyle choices come together, you can make confident and informed decisions. And when you have a knowledgeable real estate team guiding you, the process becomes even smoother.

If you would like help estimating the cost of living for a specific home or neighborhood, our team would be honored to support you with clear guidance, local expertise, and a personalized approach to homeownership.