How to Improve Your Credit Score Before Buying a House?

If you are thinking about buying a home in Savannah or any of its charming surrounding communities like Pooler, Richmond Hill, or Wilmington Island, your journey begins with more than just choosing your dream home. It starts with understanding your finances — and specifically, your credit score.

Your credit score tells a story about how you handle money, repay loans, and manage your responsibilities. It is the number lenders look at first before deciding whether you qualify for a mortgage and what interest rate you will get. And in a competitive housing market like Savannah’s, that number can make all the difference between securing the home you love or missing out.

The good news is, even if your score is not perfect, you can take steps right now to improve it — often faster than you might think. Let’s talk about how your credit score impacts your ability to buy a home, what local lenders in Savannah are looking for, and how you can raise your score to put yourself in the best position possible.

Why Your Credit Score Matters in Today’s Market

A credit score is a three-digit number that tells lenders how likely you are to repay borrowed money on time. The higher your score, the more confident lenders feel in your ability to handle a mortgage responsibly.

Think of it as your financial trust rating. When your score is strong, you have access to lower interest rates, better loan terms, and often faster approval. But when it’s lower, you may face higher rates, stricter conditions, or additional documentation requirements.

In Georgia, the average FICO score is around 695, just slightly below the national average of 715. For many Savannah buyers, that means they are already in a good place but could gain thousands in savings by improving their score even a little.

Here’s how those numbers usually translate into mortgage opportunities:

-

Excellent credit (740 and above): Best interest rates and loan terms available.

-

Good credit (700–739): Competitive rates and smoother approval.

-

Fair credit (640–699): Still eligible for most programs, but may face slightly higher rates.

-

Below 640: May need specialized programs like FHA or VA loans and stronger documentation.

A difference of just 20 or 30 points could change your loan rate by half a percent — which might save you tens of thousands over the life of your mortgage.

What Credit Score You Need to Buy a Home in Savannah

Not every home loan is the same, and not every buyer’s financial picture fits into a single box. Here’s what local lenders across Savannah and Coastal Georgia typically require for different types of mortgages:

-

Conventional Loans: Minimum score of 620. These are the most common loans, ideal for buyers with stable income and moderate to strong credit.

-

FHA Loans: Minimum score of 580 for a 3.5% down payment. Some lenders allow lower scores (as low as 500) with larger down payments.

-

VA Loans: Usually around 620, though it depends on the lender. Designed for active or retired military members.

-

USDA Loans: Minimum score around 640, available for buyers in designated rural areas, including parts of Bryan, Effingham, and Liberty Counties.

Understanding your credit score and matching it with the right loan type can be the difference between stress and confidence as you begin your search.

Step 1: Check Your Credit Report — Know Where You Stand

Before you can improve your credit score, you need to know what’s affecting it.

Visit AnnualCreditReport.com, where you can access free copies of your reports from all three major bureaus — Equifax, Experian, and TransUnion.

Look for errors such as:

-

Payments marked late when they were actually on time

-

Accounts that do not belong to you

-

Debts that should have been removed after being paid off

Even small mistakes can hurt your score. If you find any, file a dispute with the credit bureau right away. This process usually takes 30 to 45 days, but once corrected, it can significantly boost your credit profile.

Step 2: Understand What Affects Your Credit Score

Five main factors determine your score:

-

Payment History (35%) — Paying bills on time is the single biggest factor.

-

Credit Utilization (30%) — How much of your available credit you’re using.

-

Length of Credit History (15%) — Older accounts help establish long-term trust.

-

New Credit Inquiries (10%) — Too many recent applications can lower your score.

-

Credit Mix (10%) — A balance between credit cards, auto loans, and installment loans helps demonstrate responsible management.

Understanding these factors helps you focus on the areas where improvement will matter most.

Step 3: Pay Down Your Balances

Credit utilization is a quick-impact area that many buyers overlook.

If you are using more than 30 percent of your available credit, it can signal to lenders that you are stretched thin. Ideally, you want to stay below 25 percent, and even lower if possible.

For example, if your total credit limit is $10,000, try to keep your balances below $2,500. Paying down debt or spreading out balances across multiple accounts can reduce this ratio and give your score an immediate boost.

Step 4: Make Every Payment on Time

Your payment history carries the most weight. A single missed payment can drop your score by 60 to 100 points.

To stay on track, set up automatic payments or reminders. Many Savannah buyers use online banking tools to schedule bill pay in advance, ensuring nothing slips through the cracks.

If you’ve missed a payment in the past, contact your creditor to see if they offer forgiveness after a period of consistent on-time payments. Some companies are willing to remove one-time errors from your report.

Step 5: Avoid Opening or Closing Too Many Accounts

Every time you apply for new credit, your score can dip slightly because of a “hard inquiry.” These temporary drops can add up if you apply for several cards or loans within a few months.

If you are planning to buy a home, avoid opening new accounts unless absolutely necessary. It is also best not to close old ones, especially if they are in good standing, since that can shorten your credit history and increase your utilization ratio.

Step 6: Build Positive Credit if You Are Just Starting Out

For first-time buyers or those rebuilding their credit, consider using a secured credit card or a credit-builder loan.

With a secured card, you put down a deposit that acts as your limit, usually between $200 and $500. Use it for small, manageable purchases and pay it off each month. Over time, this builds payment history and demonstrates responsible use.

Some Savannah-based credit unions and local banks offer secured cards designed for new borrowers, which can be a great way to get started.

Step 7: Use Experiential Tools and Apps Wisely

In 2025, more tools than ever are available to help you monitor and improve your credit. Apps like Experian Boost or Credit Karma allow you to track your score and even add utility or phone payments to your report.

While not every lender counts those additions, they can help create consistency and show positive payment behavior.

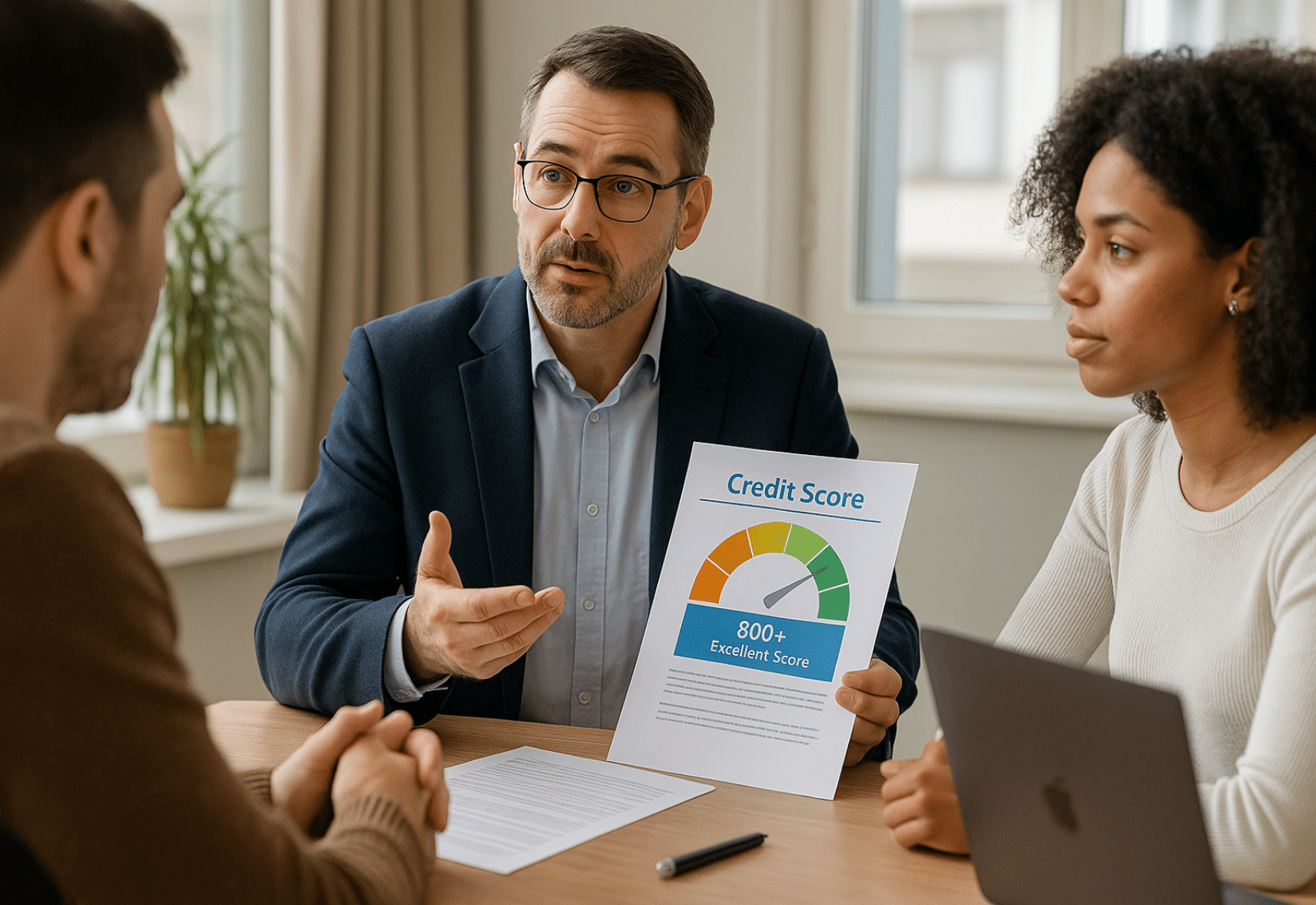

Step 8: Work with a Lender Who Understands Your Situation

Not every lender views credit the same way. That is why working with a local expert who understands Savannah’s market can make all the difference.

At Heather Murphy Group, we collaborate with trusted lending professionals who guide our clients through every step of credit readiness and preapproval. Our partners — Jarad Brown and Kelly Sullivan of New American Funding, Michael Caputo of First Coast Mortgage, and Ivy Eilerman — specialize in helping buyers improve their financial position before applying.

They analyze your credit report, identify areas for improvement, and recommend personalized solutions. Whether it means consolidating debt, adjusting balances, or exploring loan programs for first-time buyers, they are here to help you get mortgage-ready.

Step 9: Keep Your Credit Stable During the Homebuying Process

Once your score improves and you are preapproved, protect it until you close. Avoid taking on new loans or financing big purchases such as cars, furniture, or appliances.

Even after preapproval, lenders often check your credit again before closing. A new line of credit or a sudden spike in debt can cause your approval to be delayed or even denied.

Keep things steady, make payments on time, and wait until after closing day to make larger financial moves.

Step 10: Give It Time and Stay Consistent

Improving your credit is not an overnight process. Small, steady steps will lead to long-term results.

Many buyers begin to see improvement within three months, while others may take six months to a year to reach their target range. The key is not to rush the process but to stay consistent with positive habits.

Remember, buying a home is a long-term investment, and so is your financial health.

The Connection Between Credit and Confidence

When your credit score is strong, it gives you more than just better mortgage options — it gives you confidence. You can shop for homes knowing exactly what you can afford, and sellers view you as a serious, prepared buyer.

It also helps you think about the long-term picture, not just the purchase. With better rates and lower payments, you have more room to save, travel, and build equity faster.

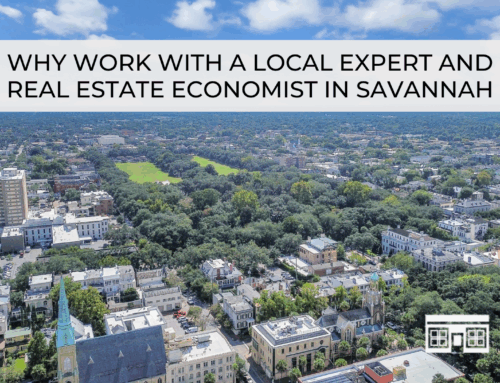

The Savannah Buyer Advantage

The Savannah housing market continues to attract buyers from across the country, drawn to its mix of coastal living, rich history, and affordability compared to other major cities.

Even with fluctuating mortgage rates, homes in Savannah remain in steady demand, and many buyers are realizing that waiting can cost more than acting now.

By improving your credit score and getting preapproved early, you put yourself ahead of the curve — especially in desirable areas like Ardsley Park, Southbridge, Richmond Hill, and Pooler. You’ll also be ready to act quickly when the perfect home comes along.

How Heather Murphy Group Helps Buyers Prepare

At Heather Murphy Group, we do more than find homes — we help you plan your future with confidence.

Our team understands that every buyer’s situation is unique. We connect you with professionals who can review your financial profile, provide personalized guidance, and set realistic timelines. Whether you are improving your score, saving for a down payment, or comparing loan options, we make sure you never feel overwhelmed.

We also work closely with our lender partners to align the financial and emotional sides of homeownership. That means when you walk into your new home, you are not only proud of the keys in your hand but also secure in the investment you’ve made.

Local Tips for Savannah Buyers

-

Monitor your property taxes and insurance: These can vary by neighborhood, so plan them into your budget early.

-

Stay connected to your lender: A quick check-in every few weeks can ensure your credit improvements are tracked and recognized.

-

Leverage local first-time buyer programs: Chatham and Bryan Counties often offer grants or down payment assistance that can offset costs if you meet credit and income requirements.

-

Keep documentation handy: Pay stubs, tax returns, and bank statements will all help your lender during preapproval.

-

Plan for future purchases wisely: Think ahead about furniture or renovations but wait until after closing to finance them.

The Power of Preparation

When you take the time to strengthen your credit score before buying a home, you are not just preparing for a mortgage — you are setting the foundation for your financial future.

You’ll enter the homebuying process with less stress, more clarity, and stronger negotiating power. You’ll know exactly what you can afford and feel proud of the work that got you there.

Ready to Begin Your Home Journey

If you are ready to buy a home in Savannah or Coastal Georgia, let’s start by reviewing your financial goals. Our team at Heather Murphy Group will connect you with trusted local lenders who can help you evaluate your credit, create a customized improvement plan, and guide you toward preapproval.

Together, we’ll help you prepare, plan, and purchase with confidence.

Contact us today

Direct 912 335 3956

Office 912 356 5001

Visit heathermurphygroup dot com

Heather Murphy Group

Keller Williams Coastal Area Partners

Proudly serving Savannah, Pooler, Richmond Hill, and Coastal Georgia — helping families move forward with purpose and peace of mind.