Is PMI Forever? The Truth About Private Mortgage Insurance

For many homebuyers in Savannah, the idea of private mortgage insurance—better known as PMI—can feel confusing or even intimidating. You may have heard that if you do not put twenty percent down, you are “stuck with PMI forever.” This belief has stopped many would-be buyers from even exploring their options.

Here’s the good news: PMI is not permanent. In fact, it is simply a temporary safeguard for lenders, and there are clear ways to remove it once you build enough equity in your home.

Let’s take a closer look at what PMI actually is, why it exists, how it impacts buyers in Savannah and surrounding communities, and how you can eliminate it over time.

What Is PMI and Why Does It Exist?

Private Mortgage Insurance is an insurance policy that protects the lender, not the buyer. It is required when you put less than twenty percent down on a conventional loan. The logic is simple: the lower your initial equity, the higher the risk to the lender if the loan defaults.

PMI reduces that risk, allowing lenders to offer loans to buyers who may not have large amounts of cash saved. Without PMI, many first-time buyers and families in Pooler, Richmond Hill, and Savannah Quarters would be locked out of the housing market.

How Much Does PMI Cost?

PMI costs vary but generally fall between 0.3% and 1.5% of the loan amount per year.

Here is what that looks like in Savannah where the median home price is around three hundred forty thousand dollars:

-

With 5% down ($17,000), your loan amount is about $323,000.

-

If PMI is 0.5% annually, that adds about $134 a month to your mortgage payment.

-

If PMI is 1%, that’s about $269 a month.

For many buyers, PMI feels like an added burden, but in reality, it can be the key that unlocks homeownership years sooner. Paying a couple hundred dollars a month is often far less than waiting several years to save tens of thousands more.

How Long Do You Have to Pay PMI?

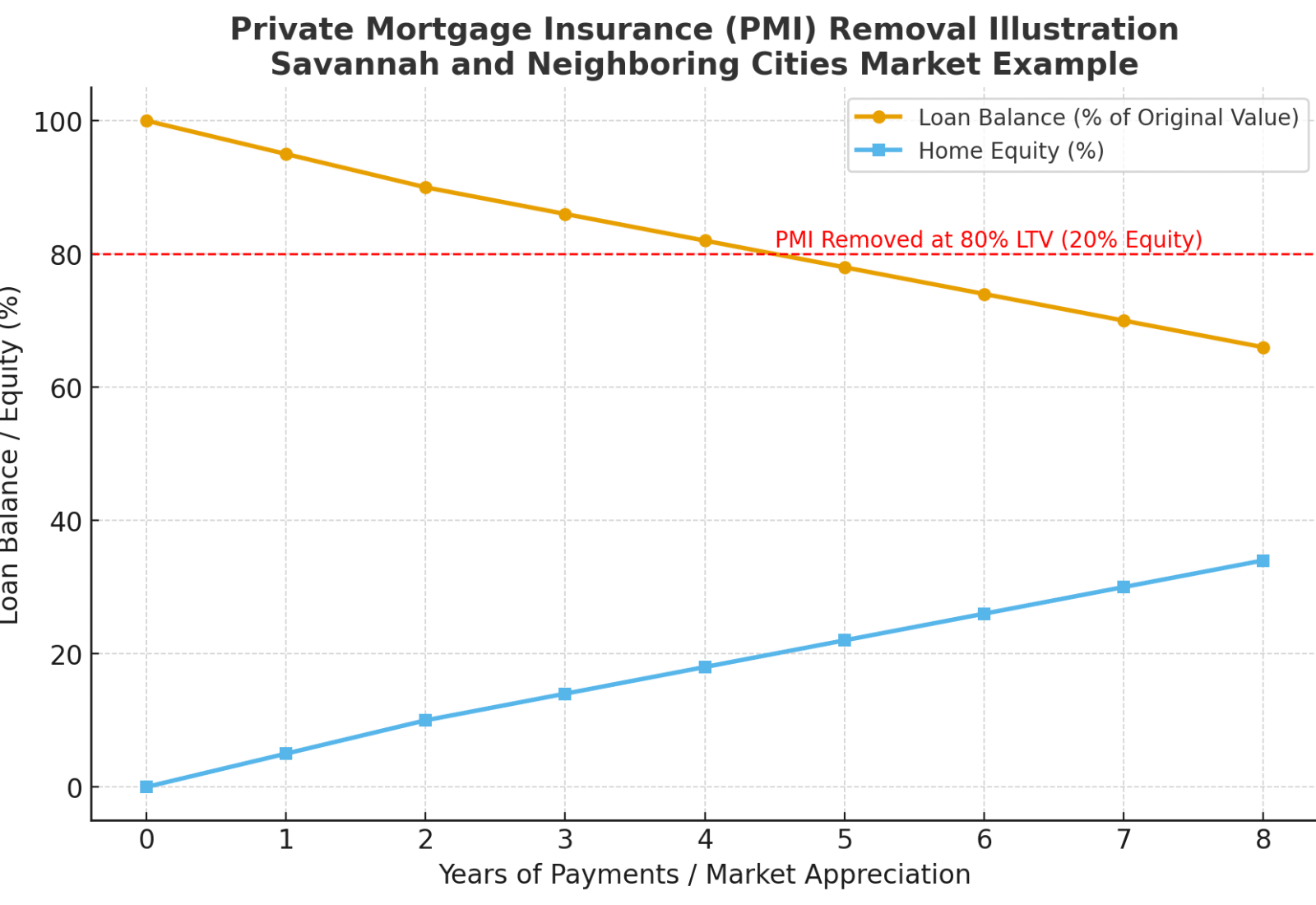

Here is where the myth of “PMI is forever” breaks down. PMI is designed to go away once you reach a safe level of equity.

-

Automatic Cancellation: By law, lenders must automatically remove PMI once your loan balance reaches 78% of the original home value.

-

Borrower-Initiated Removal: You can request removal earlier—once you reach 80% loan-to-value—by contacting your lender. This often happens as you make payments and your loan balance decreases.

-

Property Appreciation: If your home value rises, you may reach that 80% threshold faster. For example, if your $340,000 home appreciates to $374,000, your equity grows without you having to pay down the full loan. An appraisal can confirm this value and help remove PMI sooner.

Local Market Example

Let’s say you buy a home in Pooler for $340,000 with 5% down. After three years, your balance might be around $306,000. If the home has appreciated just 5% during that time, its value is now $357,000. That means your equity has grown to about 14%. You are now close to requesting PMI removal before the automatic cancellation kicks in.

In Savannah’s market, where some neighborhoods like Richmond Hill and parts of Westbrook have seen steady demand, appreciation can make PMI disappear faster than buyers expect.

FHA and VA Loans: A Different Story

It is important to note that PMI applies to conventional loans. FHA and VA loans have their own rules.

-

FHA Loans: These come with a Mortgage Insurance Premium (MIP). For most FHA loans, the MIP lasts for the life of the loan unless you refinance into a conventional loan. While this may sound discouraging, FHA’s low 3.5% down payment often outweighs the long-term insurance cost for first-time buyers who later refinance.

-

VA Loans: These do not require PMI at all. Eligible service members, veterans, and surviving spouses can purchase with zero down and no monthly insurance. This is one of the strongest benefits available in Savannah where many families are connected to the military.

Why PMI Is Not the Enemy

Instead of viewing PMI as wasted money, think of it as a bridge. It is what allows you to buy today instead of waiting for years. During those years, home prices may rise, interest rates may change, and the cost of waiting can outweigh the temporary PMI expense.

For many Savannah buyers, PMI is simply part of the early stage of homeownership. The key is knowing that it has an expiration date.

How to Remove PMI Faster

Here are strategies buyers in Savannah can use to drop PMI sooner:

-

Make Extra Payments: Even small additional principal payments each month help you reach that 80% loan-to-value mark faster.

-

Track Home Values: Stay in touch with your Realtor for updates on local market appreciation. If your neighborhood is climbing in value, you may qualify to remove PMI sooner than expected.

-

Schedule an Appraisal: When you believe your equity has grown, request an appraisal from your lender to verify it.

-

Refinance: If rates drop or your financial situation improves, refinancing into a new loan may eliminate PMI.

Savannah Buyer Stories

-

First-Time Buyer in Richmond Hill: A family bought with 3% down on a conventional loan. Within four years, thanks to steady appreciation and a few extra payments, they were able to request PMI removal two years earlier than expected.

-

Military Family in Pooler: Chose a VA loan with zero down and never had to deal with PMI at all. Their monthly payment was lower than renting, even without twenty percent saved.

-

Young Professional in Historic Savannah: Purchased with 5% down using conventional financing. Rising values in their neighborhood allowed PMI removal after just three years.

These stories show that PMI is a temporary stage—not a permanent weight.

Why Work with a Local Expert

Navigating PMI is easier when you have a Realtor and lender who understand the local market. Heather Murphy Group works directly with buyers to set realistic expectations about down payments and PMI. We collaborate with a network of trusted local lenders, including partners like Jarad Brown with New American Funding, who help buyers explore loan programs that balance affordability with long-term financial goals.

By combining local market insight with loan expertise, buyers gain confidence. Instead of fearing PMI, they understand how it fits into their overall strategy.

Conclusion

PMI is not forever. It is simply a temporary cost that helps you buy a home sooner rather than later. With the right planning, appreciation, and guidance, most Savannah buyers can remove PMI within a few years.

At Heather Murphy Group, we are here to walk you through every stage of the process, from choosing the right loan program to building equity and eventually eliminating PMI. If you are ready to explore your options, call us today at 912-335-3956 or visit heathermurphygroup.com. Your path to homeownership may be closer than you think.