What Every Savannah Buyer Needs to Know About Flood Zones and Insurance?

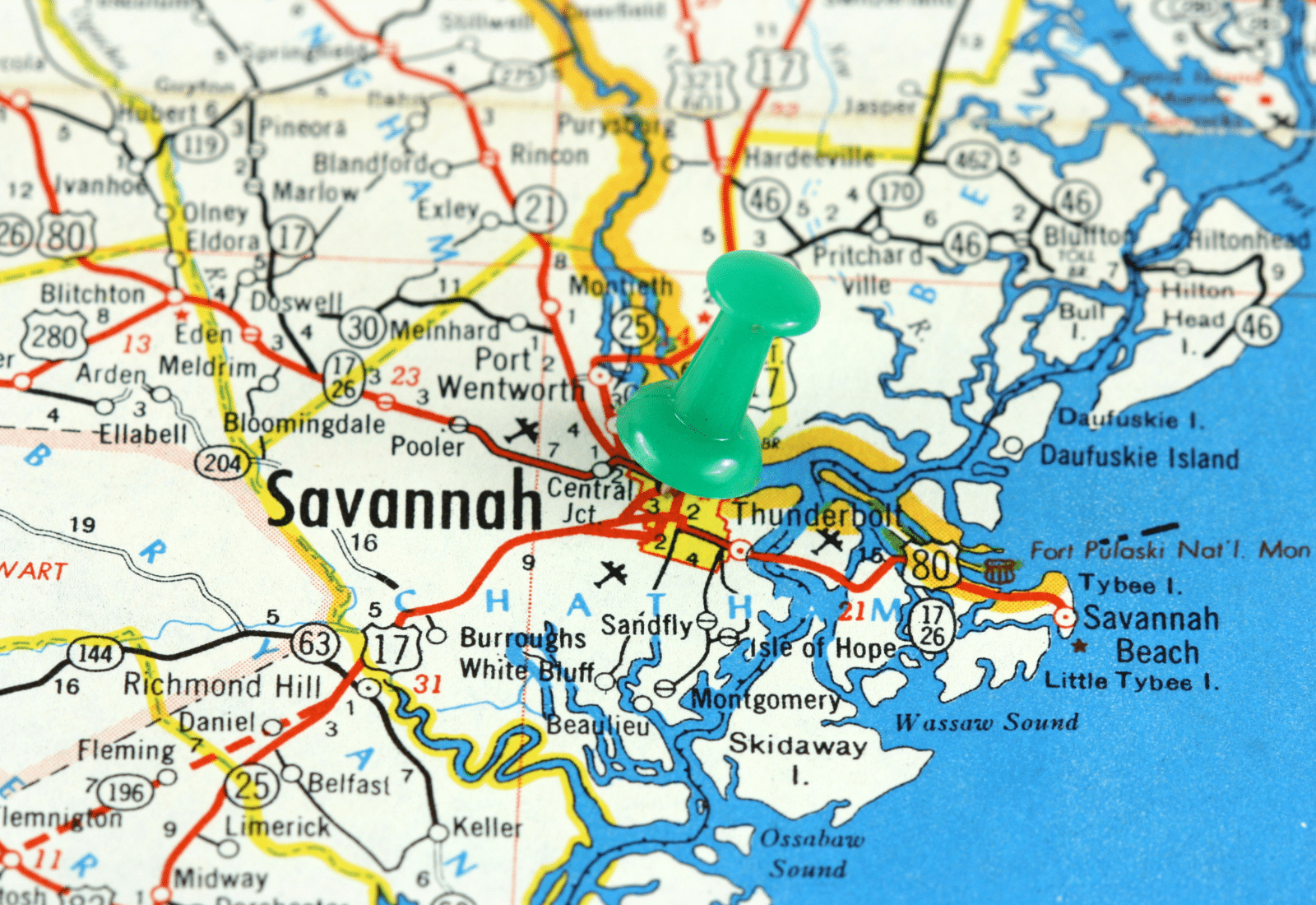

Buying a home in Savannah means choosing a lifestyle shaped by beauty, charm, and the natural rhythm of living near the coast. Whether you are considering a historic home in Ardsley Park, a waterfront cottage on Isle of Hope, or a family home on Wilmington Island, understanding flood zones and flood insurance should be part of your decision making process. You do not need to be an expert. You simply need clarity, confidence, and the right guidance along the way.

This guide will help you understand the essentials without overwhelming you with technical details. If you want deeper insight tailored to a specific property or neighborhood, our team is always here to support you.

What Are Flood Zones and Why Do They Matter for Savannah Buyers?

Flood zones are FEMA’s way of identifying the likelihood of flooding in different areas. They help you understand whether a property is considered high, moderate, or low risk. In Savannah, these zones are a natural part of coastal living and they vary widely by street, elevation, and proximity to water.

Most of Savannah sits in low and moderate risk zones such as X and X Five Hundred. Some waterfront and marsh adjacent neighborhoods include higher risk designations like A, AE, AH, or VE. These zones do not tell the full story but they provide a helpful starting point as you evaluate homes.

Many of Savannah’s most desirable communities include a mix of zone types and continue to enjoy steady demand. What matters most is knowing your risk level and understanding what it means for your long term plans.

How Can You Check the Flood Zone for a Savannah Property?

The most accurate way to check a property’s flood zone is through official mapping tools such as FEMA’s Flood Map Service Center, the Georgia DFIRM viewer, or the local SAGIS system. These resources show whether a property falls in a Special Flood Hazard Area or a lower risk zone.

Even so, maps do not tell the entire story. Two homes in the same zone can have completely different levels of exposure depending on elevation, lot position, drainage patterns, and nearby water sources. That is why buyers are encouraged to review the maps and then discuss the findings with a local expert who understands the nuances of Savannah’s geography.

Flood maps are updated periodically so relying on older assumptions or outdated listings can lead to surprises. When you are working with our team, we help you interpret the information and understand what it means for your search.

Do All Savannah Buyers Need Flood Insurance?

Flood insurance is separate from homeowners’ insurance. A standard home insurance policy does not cover flood damag,e which is why flood insurance exists as its own form of protection.

If you purchase a home in a high risk zone and use a federally backed mortgage, your lender will likely require flood insurance. Buyers in moderate or low-risk zones may not be required to carry coverage but many choose to for added peace of mind.

The right choice depends on the property’s specific characteristics and your individual comfort level. Since every property is different, it is helpful to consult with a licensed insurance professional once you narrow down your home options. Our team can guide you through the right questions to ask so you feel prepared and informed.

How Has Flood Insurance Pricing Changed in Savannah?

FEMA’s updated Risk Rating 2.0 system changed how flood insurance premiums are calculated. Instead of relying mainly on large geographic zones, the new system considers unique features of each home including elevation, distance to water, and structural characteristics.

This means a home in Zone X could have a different premium than another home in the same area. It also means pricing is more tailored and property-specific. The goal is not for you to figure out the details on your own. The most important thing to know is that the new system focuses on individual risk, which can work in your favor depending on the property.

Savannah and Chatham County also participate in FEMA’s Community Rating System, which can provide discounts for homeowners. Your exact benefits depend on the home and policy and are best reviewed with an insurance professional.

What Should Buyers Look For When Viewing Homes in Potential Flood Areas?

You do not need to evaluate homes like an engineer, but you should be aware of a few helpful details when touring properties.

• General elevation of the lot

• How water naturally drains around the home

• The type of foundation

• Whether the property has been elevated or improved

• The surrounding topography

These early observations are simply a starting point. Your inspector, insurance professional, and our team will help you understand the bigger picture once you find a home you love.

Can Buyers Get Flood Insurance Even If a Property Is Not in a High Risk Zone?

Yes. Many buyers choose to carry flood insurance even when it is not required by their lender. This decision often provides added peace of mind especially in areas where heavy rain, drainage issues, or hurricanes may influence conditions throughout the year.

Optional coverage can be surprisingly flexible depending on the property. Instead of making assumptions, it is best to explore your options once you identify homes that are serious contenders.

How Do Flood Zone Maps Affect Homeowners’ Insurance Policies?

Homeowners insurance and flood insurance work together, but they serve different purposes. Flood zone maps influence whether flood insurance is required, not the general homeowners policy itself.

For buyers, the takeaway is simple. A flood zone does not automatically mean higher homeowners’ insurance. Each coverage type follows its own rules. This is another reason why working with knowledgeable agents makes the process easier and more reassuring.

What Role Does Our Team Play in Helping You Navigate This Process?

Living in a coastal city means flood awareness is part of being a responsible homeowner. You do not need to memorize FEMA codes or study engineering maps. You simply need a team that understands Savannah’s landscape and knows how to guide you through the key steps with clarity and calm.

We help you:

• Understand what each flood zone means

• Interpret official maps without feeling overwhelmed

• Connect with the right professionals when needed

• Evaluate insurance expectations for specific homes

• Feel confident about your long term investment

Everything becomes easier when you have the right support.

Your Next Step in the Savannah Homebuying Journey

Flood zones and insurance do not need to complicate your home search. With the right information and a trusted team by your side, this part of the process becomes manageable, straightforward, and empowering.

If you want to explore specific neighborhoods, compare properties, or understand how flood zones may affect your next move, our team is here to guide you with clarity and confidence. When you are ready, we will help you find the home that truly fits your life in Savannah.